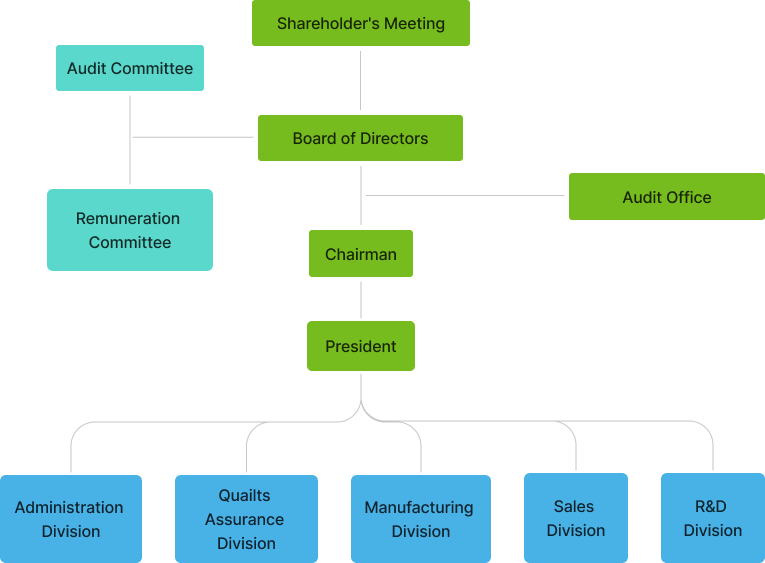

Organizational Structure

Overview of the business operations of the main departments

- Promulgating and periodically reviewing the policy, system, standard and composition of Directors and executive officer’s evaluation and remuneration.

- Promulgating and periodically evaluating Directors and executive officer’s remuneration.

- Inspect and evaluate the soundness of the internal control system, and provide analysis and assessment recommendations.

- Provide suggestions and improvements regarding the implementation of laws, regulations, and systems.

- Audit of various operational processes and execution of self-assessment procedures.

- Execution of personnel, administrative, and general affairs.

- Development and improvement of organization, culture, and human resources

- Design, planning, and management of office IT.

- Formulation and implementation of information security policies.

- Financial operations and planning.

- Cash management, accounting and tax processing, business analysis, and other financial and accounting tasks.

7. Drafting and management of various contracts; consultation and handling of legal disputes, litigation, or non-litigation cases; and the promotion and management of various legal projects.

Execute quality control work target plan, ISO control, product quality management related matters and customer service.

Engage in the execution of production, production management, and property management related businesses to ensure the achievement of production plans.

- Handling sales business and order-related matters.

- Market intelligence collection and marketing activity planning and execution.

- Answers and assistance to customer-related questions

Product development and design.

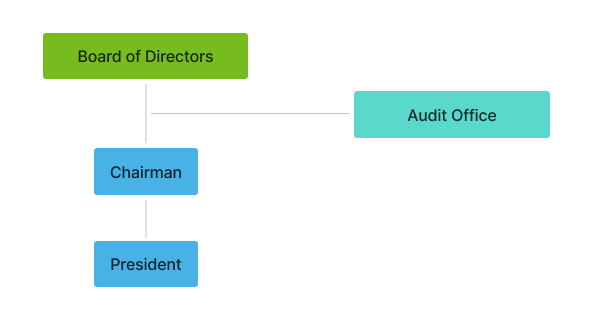

Audit organizational structure

Internal Audit System

The purpose of internal audit is to assist the board of directors and managers to inspect and review the internal control system and measure operational efficiency. Internal auditors should uphold a super-independent spirit, truly perform their duties from an objective and impartial standpoint, and perform internal audit work in accordance with rules and regulations. Each year, an audit plan for the following year is drawn up based on the risk assessment results, and is submitted to the board of directors for approval before being submitted to the competent authority for reference.

The company has established an internal audit unit affiliated with the board of directors, with one audit supervisor and one internal auditor. The Company follows the Code of Corporate Governance Practice. The appointment, removal, evaluation, and salary remuneration of internal auditors are signed by the audit supervisor and reported to the chairman of the board for approval.

Audit Operation Instructions

Prepare an audit plan for the next year before the end of each fiscal year, and report to the competent authority before the end of February each year the implementation of the previous year‘s audit plan and the improvement of abnormal matters found in the previous year’s internal audit before the end of May. for future reference.

After the department being inspected is notified and the department conducts its own inspection, the audit office will then perform the audit in accordance with the company‘s current internal control system and regulations.